Enriching Our ModelĪs discussed earlier, we have previously modelled private markets. A positive externality occurs when the market interaction of others presents a benefit to non-market participants. The club imposed a cost on you, an external agent to the market interaction. The club example from above is that of a negative externality. Because externalities that occur in market transactions affect other parties beyond those involved, they are sometimes called spillovers.Externalities can be negative or positive. The effect of a market exchange on a third party who is outside or “external” to the exchange is called an externality.

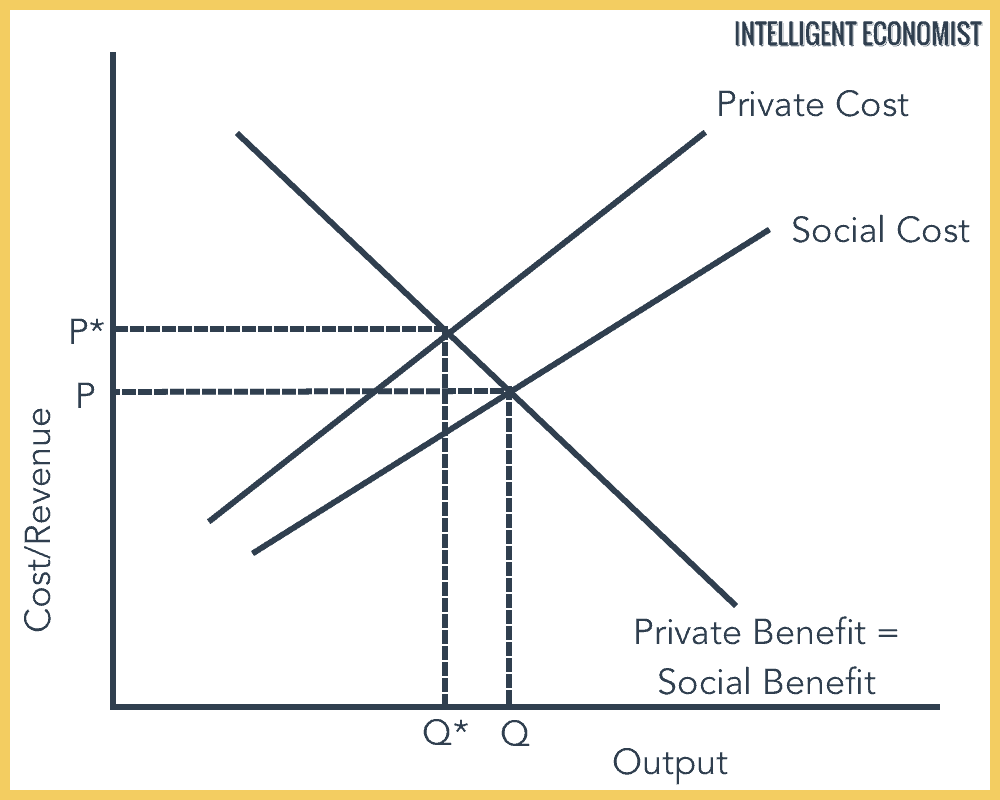

In this case, the club’s owners and attendees may both be quite satisfied with their voluntary exchange, but you have no voice in their market transaction. But what happens when a voluntary exchange affects a third party who is neither the buyer nor the seller?As an example, consider a club promoter who wants to build a night club right next to your apartment building. You and your neighbours will be able to hear the music in your apartments late into the night. The principle that voluntary exchange benefits both buyers and sellers is a fundamental building block of the economic way of thinking. Private markets only consider consumers, producers and the government – the impacts on external parties is irrelevant. The perfectly competitive market we modelled offered an efficient way to put buyers and sellers together and determine what goods are produced, how they are produced, and who gets them. Externalities To this point, we have modelled private markets. Before we get to this conclusion, let’s first unpack this concept of externalities. We will learn that the all-regulation-is-bad-regulation conclusion from earlier is not always the case – in many situations, we can improve societal outcomes with policy. We will find that the equilibrium that is optimal for consumers and producers of the good may be sub-optimal for society. We can now add the concept of Externalities to our supply and demand model to account for the impact of market interactions on external agents. Our assumption throughout this analysis, however, was that there was no third party impacted by the interaction of producers and consumers. quota, price control, tax, etc.) moved the market away from the surplus maximizing equilibrium and created a deadweight loss. We also demonstrated that any policy that was introduced (i.e. We observed how producers and consumers of a good interacted to reach equilibrium.

In particular, we closely examined perfectly competitive markets. In Topics 3 and 4 we introduced the concept of a market. Identify equilibrium price and quantity.Explain and give examples of positive and negative externalities.By the end of this section, you will be able to:

0 kommentar(er)

0 kommentar(er)